SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| Preliminary Proxy Statement | ||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to | |

Rule 14a-11(c) or Rule 14a-12 | ||

TRANSGENOMIC, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee |

| $125 per Exchange Act Rule O-11(c)(1)(ii), 14a-6(i)(2) or Item 22(a)(2) of Schedule 14A. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

Fee paid previously with preliminary materials. | ||||

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number or the Form or Schedule and the date of its filing. | ||||

(1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERSMAY 21, 2003

July 13, 2005

The Annual Meeting of Stockholders of Transgenomic, Inc. (the "Company"“Company”) will be held at the offices of INVESCO Private Capital, 1166 Avenue of the Americas, New York, New York, on Wednesday, May 21, 2003,July 13, 2005, at 10:30 a.m. Eastern Daylight Time, for the following purposes:

| (1) | To elect two Class II directors. |

| (2) | To ratify the appointment of Deloitte & Touche LLP as independent auditor for the Company for the year ending December 31, 2005. |

| (3) | To authorize the Company to issue an unlimited number of shares under its $7.5 million convertible revolving credit line with Laurus Master Fund, Ltd. and associated warrants, which may exceed 20% of the shares outstanding on the date the Company entered into the revolving credit line. |

| (4) | To transact such other business as may properly come before the meeting or any adjournment thereof. |

Please read the enclosed Proxy Statement for important information about the Annual Meeting.

Only stockholders of record at the close of business on March 24, 2003,June 27, 2005, are entitled to notice of, and to vote at, the Annual Meeting.

Please sign and return the enclosed proxy card using the envelope provided. You can revoke your proxy at any time. If you attend the Annual Meeting in person you may withdraw your proxy and vote in person.

By Order of the Board of Directors

Mitchell L. Murphy,Secretary

Omaha, NebraskaApril 18, 2003

June 22, 2005

IMPORTANT: IT IS IMPORTANT THAT WE RECEIVE YOUR PROXY TO ENSURE A QUORUM AT THE ANNUAL MEETING. BY PROMPTLY RETURNING YOUR PROXY CARD TO US, YOU WILL SAVE THE COMPANY THE EXPENSE OF FURTHER PROXY SOLICITATION.

Transgenomic, Inc.

12325 Emmet Street

Omaha, Nebraska 68164

PROXY STATEMENT

for

ANNUAL MEETING OF STOCKHOLDERS

of

TRANSGENOMIC, INC.

We are sending this Proxy Statement to you in connection with our request for your proxy to use at the Annual Meeting of Stockholders of Transgenomic, Inc. (the "Company"“Company”) to be held on May 21, 2003.July 13, 2005. Only those owners of our common stock of record at the close of business on March 24, 2003June 27, 2005 (the "Record Date"“Record Date”) are entitled to vote at the Annual Meeting. This Proxy Statement, along with the Notice of the Annual Meeting, the Annual Report to Stockholders and a proxy card are being first mailed to stockholders on or about April 18, 2003.June 22, 2005.

Your proxy is being solicited by the Board of Directors of the Company and will give them the power to vote on your behalf at the Annual Meeting. All shares of the Company'sCompany’s common stock represented by properly executed and unrevoked proxies will be voted by the Board of Directors in accordance with the directions given by those proxies. Where no instructions are indicated, the Board of Directors will vote "FOR"“FOR” each of the proposals that will be considered at the Annual Meeting. In addition, the Board of Directors believes outstanding shares owned by executive officers and directors of the Company will be voted "FOR"“FOR” each such proposal. Shares owned by these persons represent approximately 20%14% of the total shares outstanding as of the Record Date.

You may revoke your proxy at any time before it is exercised by the Board of Directors at the Annual Meeting. If you decide to do this, you will need to give the Secretary of the Company written notice that you want to revoke the proxy or you can submit a new proxy to him. In addition, if you attend the Annual Meeting in person, you may withdraw your proxy and vote in person. Shares of common stock entitled to vote and represented by properly executed, returned and unrevoked proxies will be considered present at the Annual Meeting for purposes of establishing a quorum. This includes shares for which votes are withheld, abstentions are cast or there are broker nonvotes. The holders of at least a majority of our common stock issued and outstanding on the Record Date must be present at the Annual Meeting, either in person or by proxy, in order for there to be a quorum.

Voting Securities and Beneficial Ownership by Principal Stockholders and Our Directors and Officers

On the Record Date there were 23,532,04934,238,970 issued and outstanding shares of our common stock. Each share of common stock is entitled to one vote on each matter to be voted on at the Annual Meeting. Stockholders do not have the right to cumulate votes in the election of directors.

This table shows the beneficial ownership of our common stock by our directors, by those of our executive officers who are named in the Summary Compensation Table, shown on page 7, by all of our current executive officers and directors as a group, and by each person we believe beneficially owns more than 5% of our outstanding common stock.stock as of June 27, 2005, the record date established for our Annual Meeting of Stockholders. Each stockholder named in this table has sole voting and investment power over the shares he beneficially owns and all such shares are owned directly by the stockholder unless otherwise indicated. Stock ownership information of persons other

than our

executive officers and directors is based on Schedules 13D, 13F or 13G filed with the Securities and Exchange Commission. The information in this table is as of the Record Date.

Name | Number of Shares Beneficially Owned | Percent of Class | |||||||||

Directors and Executive Officers | |||||||||||

Collin J. | 4,656,154 | (1) | % | ||||||||

Michael A. Summers, Chief Financial Officer | (2) | ||||||||||

Mitchell L. Murphy, Vice President, Secretary and Treasurer | (3) | * | |||||||||

Gregory J. Duman, Director | (4) | * | |||||||||

Jeffrey L. | (5) | * | |||||||||

Roland J. Santoni, Director | (6) | * | |||||||||

Parag Saxena, Director | (7) | * | |||||||||

Gregory T. Sloma, Director | (8) | * | |||||||||

All directors and executive officers as a group | (9) | ||||||||||

Other Shareholders | |||||||||||

Kopp Investment Advisors, Inc. | (10) | ||||||||||

Mazama Capital | (11) | ||||||||||

INVESCO Private Capital, | |||||||||||

| 6.7 | |||||||||||

| Represents less than 1% of the outstanding Common Stock of the Company. |

| Includes 1,400,000 shares owned by the Arthur P. D’Silva Trust, of which Collin J. D’Silva is the sole trustee and 484,616 shares owned by D’Silva, LLC, of which Mr. D’Silva is the managing member. |

| (2) | Consists of vested options to purchase 50,000 shares at $1.09. Mr. Summers also holds unvested options to purchase an additional 50,000 shares at $1.09. |

| (3) | Consists of 4,000 shares owned by Mr. Murphy and vested options to purchase 50,000 shares at $5.00 per share, 8,000 shares at $11.94 per share, 2,500 shares at $9.91 per share, 8,000 shares at $6.38 per share, 27,500 shares at $6.24 per share and 50,000 shares at $1.92 per share. Mr. Murphy also holds unvested options to purchase an additional 2,000 shares at $11.94 per share and 2,000 shares at $6.38 per share. |

| (4) | Consists of 25,400 shares owned by Mr. Duman and vested options to purchase 12,000 shares at $10.00 per share and 200,000 shares at $6.00 per share. Mr. Duman also holds unvested options to purchase an additional 3,000 shares at $10.00 per share, and 5,000 shares at $2.57 per share. |

| (5) | Consists of vested options to purchase 15,000 shares at $5.00 per share and 9,000 shares at $13.00 per share. Dr. Sklar also holds unvested options to purchase an additional 3,000 shares at $6.38 per share, 6,000 shares at $6.16 per share and 5,000 shares at $2.57 per share. |

| (6) | Consists of 2,500 shares owned by Mr. Santoni and vested options to purchase 17,500 shares at $10.00 per share and 5,000 shares at $2.57 per share. Mr. Santoni also holds unvested options to purchase an additional 3,000 shares at $6.16 per shares, 3,000 shares at $6.00 per share and 5,000 shares at $2.57 per share. |

| (7) | Mr. Saxena holds unvested options to purchase 15,000 shares at $1.09 per share. |

| (8) | Consists of vested options to purchase 10,000 shares at $2.57 per share. Mr. Sloma also holds unvested options to purchase an additional 5,000 shares at $2.57 per share. |

| (9) | Includes vested options to acquire 540,417 shares of common stock. |

| (10) | The address of Kopp Investment Advisors, Inc. is 7701 France Avenue South, Suite 500, Edina, Minnesota 55435. |

| (11) | The address of Mazama Capital Management, LLC is One Southwest Columbia Street, Suite 1500, Portland Oregon 97258. |

| (12) | These shares are held by entities affiliated with INVESCO Private Capital, Inc., which disclaims beneficial ownership of these shares. The address of INVESCO Private Capital, Inc. is 1166 Avenue of the Americas, New York, New York 10036. |

2

3

PROPOSAL TO ELECT CLASS II DIRECTORSELECTION OF DIRECTORS

Board of Directors and Committees

Our entire Board of Directors consists of seven positions of which fivesix are currently occupied. The Board of Directors is divided into three classes with directors in each class serving for a term of three years. The terms of office of the current Class I, Class II and Class III directors will expire in 2004,2007, 2005 and 2003,2006, respectively.

The Board of Directors has nominated Gregory J. DumanT. Sloma and Roland J. SantoniJeffrey L. Sklar as Class IIIII directors to serve three-year terms expiring in 2006.2008. Mr. DumanSloma and Mr. SantoniDr. Sklar are both current members of the Board of Directors and each has expressed an intention to continue to serve on the Board of Directors if they are elected. The Board of Directors knows of no reason why either Mr. DumanSloma or Mr. SantoniDr. Sklar might be unavailable to serve. There are no arrangements or understandings between either Mr. DumanSloma or Mr. SantoniDr. Sklar and any other person pursuant to which they were selected as nominees.

The election of a director requires the affirmative vote of a plurality of the shares present in person or represented by proxy at the meeting and entitled to vote. This means that votes withheld and broker nonvotes with respect to the election of directors will have no effect on the election of directors. If Mr. DumanSloma or Mr. SantoniDr. Sklar is unable to serve as a director, the Board of Directors may nominate a substitute nominee. In that case, the Board of Directors will vote all valid proxies that voted in favor of Mr. DumanSloma or Mr. Santoni,Dr. Sklar, as the case may be, for the election of the substitute nominee.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE "FOR" THE ELECTION OF MR. DUMAN AND MR. SANTONI AS CLASS III DIRECTORS.

The Board of Directors recommends that the stockholders vote “FOR” the election of Mr. Sloma and Dr. Sklar as Class II Directors.

The following table sets forth information about our directors, including the nominees who are to be voted on at the Annual Meeting. The Board of Directors has determined that Messrs. Saxena, Sloma, Sklar and Santoni are independent directors of the Company under the listing standards adopted by the Nasdaq Stock Market. All directors have held the positions with the companies (or their predecessors) set forth under "Principal Occupation"“Principal Occupation” for at least five years, unless otherwise indicated.

| Name | Age | Principal Occupation | Director Since | Term To Expire | ||||

|---|---|---|---|---|---|---|---|---|

| NOMINEES | ||||||||

Gregory J. Duman | 47 | Professional Advisor(1) | 2000 | 2003 | ||||

| Roland J. Santoni | 61 | Professor of Law, Creighton University | 2000 | 2003 | ||||

DIRECTORS CONTINUING IN OFFICE | ||||||||

Collin J. D'Silva | 46 | President and Chief Executive Officer of the Company(2) | 1997 | 2004 | ||||

Parag Saxena | 48 | Chief Executive Officer of INVESCO Private Capital, Inc. | 1999 | 2004 | ||||

Jeffrey Sklar, M.D., Ph.D. | 55 | Professor of Pathology, Harvard Medical School(3) | 1997 | 2005 | ||||

Name | Age | Principal Occupation | Director Since | Term To Expire | ||||

| NOMINEES | ||||||||

Gregory T. Sloma | 53 | Executive Vice President and Chief Financial Officer of SpeedNet Services, Inc.(1) | 2004 | 2005 | ||||

Jeffrey L. Sklar, M.D., Ph.D. | 57 | Professor of Pathology, Yale University School of Medicine(2) | 1997 | 2005 | ||||

| DIRECTORS CONTINUING IN OFFICE | ||||||||

Gregory J. Duman | 49 | President of Prism Technologies LLC(3) | 2000 | 2006 | ||||

Roland J. Santoni | 63 | Vice President of West Development, Inc.(4) | 2000 | 2006 | ||||

Collin J. D’Silva | 48 | President and Chief Executive Officer of the Company(5) | 1997 | 2007 | ||||

Parag Saxena | 49 | Chief Executive Officer of INVESCO Private Capital, Inc. | 1999 | 2007 | ||||

3

| (1) | Mr. Sloma is also a director of West Corporation. From 1996 to 2003, Mr. Sloma served in several capacities including President, Chief Operating Officer, Chief Executive Officer, and Vice Chairman and Director of Mergers & Acquisitions for DTN Corporation. In September 2003, DTN Corporation filed a pre-packaged Chapter 11 reorganization petition in bankruptcy. DTN Corporation emerged from bankruptcy on October 31, 2003. |

4

| (2) | From 1989 to 2003, Dr. Sklar was Professor of Pathology, Harvard Medical School. |

| (3) | From 2001 to 2003, Mr. Duman was Executive Vice President and Chief Financial Officer of the Company. From 2000 to 2001, Mr. Duman was Chief Financial Officer of Artios, Inc. From 1983 to 2000, Mr. Duman served in several capacities including Controller, Chief Financial Officer and Executive Vice President of Transaction Systems Architects, Inc. |

| (4) | From 1977 to 2003, Mr. Santoni was Professor of Law at Creighton University. In addition, from 1978 to 2003, he served Of Counsel with the law firm of Erickson & Sederstrom, P.C. |

| (5) | Mr. D’Silva is also a director of Bruker Biosciences Corporation, formerly known as Bruker Daltonics, Inc. |

Information regarding our other executive officers is found in our Form 10-K10-K/A that is part of the Annual Report to Stockholders that accompanies this Proxy Statement. The Board of Directors has adopted a code of ethical conduct that applies to our principal executive officers and senior financial officers as required by Section 406 of the Sarbanes Oxley Act of 2002. This code of ethical conduct is embodied within our Business Ethics Policy, which applies to all persons associated with the Company, including our directors, officers, and employees, and complies with the listing standards adopted by the Nasdaq Stock Market. The Business Ethics Policy is available on our website at www.transgenomic.com.

The Board of Directors conducts its business through meetings of the Board and actions taken by written consent in lieu of meetings and by the actions of its committees. During the year ended December 31, 2002,2004, the Board of Directors held ninetwelve meetings and acted by written consent in lieu of a meeting three times. Allone time. Other than Mr. Saxena, all directors attended at least 75% of the meetings of the Board of Directors and of the committees of the Board of Directors on which they served during 2002.2004. Mr. Saxena attended five meetings of the Board of Directors, three Audit Committee meetings and both Compensation Committee meetings.

The Board of Directors has established and assigned certain responsibilities to an Audit Committee and a Compensation Committee. We do not have a standing nominating committee. Nominations for directorsThe Board determined that due to the relatively small size of the Board, and due to the policy on director nominations, which is described below, it was not necessary to form a separate committee to evaluate director nominations. Under the director nomination policy, director candidates are identified primarily through suggestions made by directors, management and stockholders of the entireCompany. We have implemented no material changes to the procedures by which stockholders may recommend nominees for the Board of Directors. The Board of Directors will consider director nominees recommended by stockholders that are submitted in writing to the Secretary of the Company in a timely manner and which provide necessary biographical and business experience information regarding the nominee. All candidates for director will be evaluated based on their independence, character, judgment, diversity of experience, financial or business acumen, ability to represent and act on behalf of all stockholders, and the needs of the Board. In general, the Board expects to nominate incumbent directors who express an interest in continuing to serve on the Board. The independent directors of the Company review and consider all candidates to serve as a director of the Company who are properly suggested by directors, management and stockholders of the Company, and the Board of Directors selects its nominees to serve as a director of the Company from among those candidates who are recommended to the Board of Directors by a majority of the independent directors of the Company.

Audit Committee. The Audit Committee'sCommittee’s primary duties and responsibilities include monitoring the integrity of our financial statements, monitoring the independence and performance of our external auditors, and monitoring our compliance with applicable legal and regulatory requirements. The functions of the Audit

4

Committee also include reviewing periodically with independent auditors the performance of the services for which they are engaged, including reviewing the scope of the annual audit and its results, reviewing with management and the auditors the adequacy of our internal accounting controls, reviewing with management and the auditors the financial results prior to the filing of quarterly and annual reports, and reviewing fees charged by our independent auditors. Our independent auditors report directly and are accountable solely to the Audit Committee. The Audit Committee has the sole authority to hire and fire the independent auditors and is responsible for the oversight of the performance of their duties, including ensuring the independence of the independent auditors. The Audit Committee also approves in advance the retention of, and all fees to be paid to, the independent auditors. The rendering of any auditing services and all non-auditing services by the independent auditors is subject to the approval in advance of the Audit Committee. The Audit Committee operates under a written charter which is available on our website at www.transgenomic.com. The Audit Committee is required to be composed of directors who are independent of the Company.Company under the rules of the Securities and Exchange Commission and under the listing standards of the Nasdaq Stock Market. The current members of the Audit Committee are directors Santoni, SklarSaxena and Saxena.Sloma. The Board of Directors has determined that Mr. Sloma qualifies as an “audit committee financial expert” under the rules of the Securities and Exchange Commission. The Audit Committee met sixseven times during fiscal 2002.2004.

Compensation Committee. The Compensation Committee reviews and approves our compensation policy, changes in salary levels and bonus paymentpayments to our executive officers and other management and determines the timing and terms of awards made pursuant to our stock option plan. The Compensation Committee currently consists of directors Sklar, Santoni and Saxena.Saxena, each of whom has been determined by the Board of Directors to be independent under the listing standards of the Nasdaq Stock Market. The Compensation Committee met threetwo times during 2004 and actedtook action by unanimous written consent in lieu of a meeting six times during fiscal 2002.one time.

Section 16(a) Beneficial Ownership Reporting Compliance.Compliance. Item 405 of Regulation S-K requires disclosure of any known late filing or failure by an insider to file a report required by Section 16 of the Securities Exchange Act of 1934. We believe all Section 16 reports were filed in a timely manner during 2002 except as follows:2004.

| Reporting Person | Total Number of Forms Filed Late | Total Number of Transactions Late | ||

|---|---|---|---|---|

| Jeffery Sklar | 1 | 1 | ||

| Stephen F. Dwyer | 1 | 1 | ||

| Keith A. Johnson | 1 | 0 |

Compensation of Directors

Directors who are also our officers or affiliates are not separately compensated for serving on the Board of Directors other than reimbursement for out-of-pocket expenses related to attendance at board and committee meetings. Independent directors are paid an annual retainer of $12,000. In addition, they receive a fee of $1,200 for attending meetings in person, or $600 for participating in a meeting by

5

teleconference, as well as reimbursement for out-of-pocket expenses related to attendance at board and committee meetings. Effective March 28, 2003, independentIndependent directors serving on any committee of the Board of Directors will beare paid an additional annual retainer of $2,500, except that effective January 1, 2004, the additional retainer paid to independent directors serving on the Audit Committee will be increased tois $5,000.

Our non-employee and non-affiliated directors are issued options to purchase 15,000 shares of common stock under our stock option plan upon initial appointment to the board.Board. For options granted prior to March 28, 2003, such options will vest at the rate of 20% per year of service on the board.Board. Additional grants were made from time to time so that each non-employee director would hold 15,000 unvested options at any time. Effective March 28, 2003, the options granted to a non-employee and non-affiliated director upon initial appointment to the board willBoard vest at the rate of 331/3% per year of service on the board.Board. Additional grants of options to purchase 5,000 shares of common stock will be made on a date reasonably close to each anniversary of such director'sdirector’s appointment to the boardBoard to be determined by the Compensation Committee in its sole discretion, with such options vesting on the third anniversary of the grant. All options granted to non-employee directors have exercise prices that represented or exceeded the fair market value of our stock on the grant date. Exercise prices on outstanding options granted to our non-employee directors'directors range from $5.00$2.37 to $13.00 per share.

6

5

Compensation of Executive Officers

The following table sets forth information regarding the annual and long-term compensation paid by us to our Chief Executive Officer, our three other four highest paid executive officers and atwo former executive officerofficers for services rendered during the three years ended December 31, 2002, 2001 and 2000.2004.

Summary Compensation TableSUMMARY COMPENSATION TABLE

Annual Compensation | Long-Term Compensation | ||||||||||||||||||||||||||||||||

| Awards | Payouts | ||||||||||||||||||||||||||||||||

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | (i) | |||||||||||||||||||||||||

Name and Principal Position | Year | Salary |

| ($) |

($) |

Compensation(1) ($) | Restricted Stock Award(s) ($) | Securities Underlying Options/ SARs (#) | LTIP

| Payouts(2) ($) |

Compensation(3) ($) | ||||||||||||||||||||||

Collin J. President and Chief Executive Officer | 2004 2003 2002 | ||||||||||||||||||||||||||||||||

— | — — — | — — — | — — — | ||||||||||||||||||||||||||||||

Michael A. Summers(4) Chief Financial Officer | — | — — — | — — — | — — — | — — — | — — — | 1,135 — — | ||||||||||||||||||||||||||

Mitchell L. Murphy Vice President, Secretary and Treasurer | 2004 2003 2002 | 135,544 120,000 100,538 | — — — | — — — | — — — | — 50,000 — | — — — | 14,468 5,986 8,412 | |||||||||||||||||||||||||

Keith A. Johnson(5) Vice President, General Counsel | 2004 2003 2002 | 135,392 135,000 112,673 | — — — | — — — | — — — | 25,000 65,000 35,000 | — — — | 10,890 4,776 35,036 | |||||||||||||||||||||||||

John L. Allbery Former Executive Vice President | 2004 2002 | 200,000 | |||||||||||||||||||||||||||||||

— — | — — — | — 50,000 — | — — — | ||||||||||||||||||||||||||||||

Michael J. Draper(7) Former Chief Financial Officer | 122,731 102,951 | — — — | — — — | — — — | — 75,000 7,500 | — — — | 938 6,873 5,481 | ||||||||||||||||||||||||||

| (1) | No disclosure is required in this column pursuant to applicable Securities and Exchange Commission regulations, as the aggregate value of items covered by this column does not exceed the lesser of $50,000 or 10% of the annual salary and bonus shown for each respective executive officer named. |

7

| (2) | We do not have a long-term incentive plan as defined in Item 402 of Regulation S-K under the Securities Exchange Act of 1934, as amended. |

| (3) | These amounts consist of accrued vacation to be taken in the future or paid in cash upon termination of employment, 401(k) Company matching contributions, reimbursed moving expenses and auto allowances, as applicable. |

| (4) | Mr. Summers joined the Company and assumed the role of Chief Financial Officer on July 31, 2004. |

| (5) | Mr. Johnson was appointed Vice President, General Counsel by the Board of Directors effective April 4, 2002, however, effective May 1, 2005, he will no longer serve in an executive officer position. |

| (6) | Mr. Allbery was appointed Executive Vice President by the Board of Directors effective May 23, 2001. He resigned from the Company on July 23, 2004. |

| (7) | Mr. Draper resigned as Chief Financial Officer effective March 31, 2004. |

6

Options/SAR Grants in Last Fiscal Year

The Compensation Committee may grant either qualified or non-qualified stock options to the officers and employees of the Company and nonqualified stock options to nonemployee directors and advisors under our stock option plan. The following table shows the options granted during fiscal 20022004 to those executive officers of the Company whose compensation is reported in the Summary Compensation Table.

| | | | | | Potential Realized Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(2) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (a) Name | | | | | |||||||||||

| (b) Number of Securities Underlying Options/SARs Granted (#)(1) | (c) % of Total Options/SARs Granted to Employees in Fiscal Year | (d) Exercise or Base Price ($/Sh) | (e) Expiration Date | (f) 5%($) | (g) 10%($) | ||||||||||

| Collin J. D'Silva | — | — | — | — | — | — | |||||||||

| William P. Rasmussen | — | — | — | — | — | — | |||||||||

| Gregory J. Duman | — | — | — | — | — | — | |||||||||

| John L. Allbery | — | — | — | — | — | — | |||||||||

| Mitchell L. Murphy | — | — | — | — | — | — | |||||||||

| Keith A. Johnson | 35,000 | 5.5 | % | $ | 6.16 | 4/15/2012 | $ | 135,590 | $ | 343,611 | |||||

| �� | Potential Realized Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(2) | |||||||||||||||

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | ||||||||||

Name | Number of Securities Underlying Options/SARs Granted (#)(1) | % of Total Options/SARs Granted to Employees in Fiscal Year | Exercise or Base Price ($/Sh) | Expiration Date | 5%($) | 10%($) | ||||||||||

Keith A. Johnson | 25,000 | 6.9 | % | $ | 1.32 | 5/21/2014 | $ | 21,000 | $ | 53,000 | ||||||

| (1) | The exercise price of all options granted to executive officers during fiscal 2004 is equal to the fair market value of our common stock on the date of grant. Each option expires ten years from the date of grant. No stock appreciation rights (SARs) may be granted under our stock option plan. |

8

| (2) | The dollar amounts set forth under these columns are the result of calculations of assumed appreciation in the price of our common stock at these annual rates from the respective dates of the grant to the respective expiration dates of the options. These assumptions are not intended to forecast future price appreciation of our common stock. The market price of our common stock may increase or decrease in value over the time period set forth above. |

Aggregated Option/SAR Exercises in Last Fiscal Year and FY-End Option/SAR Values

The following table sets forth certain information concerning the number of exercised and unexercised options and the value of such options at the end of fiscal 20022004 held by anythe executive officerofficers and two former executive officers of the Company whose compensation is reported in the Summary Compensation Table.

| (a) | (b) | (c) | (d) | (e) | |||||||||||||

Name |

|

|

($)(1) |

Securities Underlying Unexercised Options/SARs at Year End(#) Exercisable/ Unexercisable |

Unexercised In-the-Money Options/SARs at Year Exercisable/ Unexercisable | ||||||||||||

Collin J. | — | — | — | — | |||||||||||||

Michael A. Summers | — | — | — | ||||||||||||||

Mitchell L. Murphy | — | — | 0 / $0 | ||||||||||||||

Keith A. Johnson | — | — | 0 / $0 | ||||||||||||||

John L. | — | — | 0 / $0 | ||||||||||||||

Michael J. Draper | — | — | 0 / $0 | ||||||||||||||

| (1) | Based on the difference between the closing sale price of the Common Stock on the exercise date or December 31, 2004 and the related option exercise price. |

7

Equity Compensation Plan Information

The following equity compensation plan information summarizes plans and securities approved and not approved by security holders as of December 31, 2002:2004:

| PLAN CATEGORY | (a) Number of securities to be issued upon exercise of outstanding options, warrants and rights | (b) Weighted-average exercise price of outstanding options, warrants and rights | (c) Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column(a)) | ||||

|---|---|---|---|---|---|---|---|

| Equity compensation plans approved by security holders | 5,144,910 | $ | 6.62 | 1,101,321 | |||

| Equity compensation plans not approved by security holders | — | — | — | ||||

| Total | 5,144,910 | $ | 6.62 | 1,101,321 | |||

| (a) | (b) | (c) | |||||

PLAN CATEGORY | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | ||||

Equity compensation plans approved by security holders | 5,088,037 | $ | 5.09 | 867,727 | |||

Equity compensation plans not approved by security holders | — | — | — | ||||

Total | 5,088,037 | $ | 5.09 | 867,727 | |||

Long-Term Incentive Plans and Other Matters

The Company does

We do not maintain a long-term incentive plan or pension plan (as defined in Item 402 of SEC Regulation S-K) for itsour executive officers and hashave not repriced any options or SARs for any executive officer during the last fiscal year.

Stock Option and Other Compensation Plans

Stock Option Plan. Our ThirdFourth Amended and Restated 1997 Stock Option Plan allows us to grant options to our employees, directors and advisors, which givegives them the right to buy our common stock at a fixed price, even if the market value of our stock goes up. The Compensation Committee of our Board of Directors administers our stock option plan and it has the sole authority to set the number, exercise price, term and vesting provisions of the options granted under the plan.plan, except that any award made to a director serving on the Compensation Committee must be ratified by a majority of the entire Board of Directors. Under the terms of

9

the plan, the exercise price of an incentive stock option, as defined under the Internal Revenue Code of 1986, as amended, cannot be less than the fair market value of our common stock on the date the option is granted. In general, options will expire if not exercised within ten years from the date they are granted. The Compensation Committee may also require that an option holder remain employed by us for a specified period of time before an option may be exercised. The committee establishes these "vesting"“vesting” provisions on an individual basis. The Compensation Committee will also decide whether options will be nonqualified options or structured to be qualified options for U.S. income tax purposes. Either incentive or nonqualified stock options may be granted to employees, but only nonqualified stock options may be granted to our non-employee directors and advisors. Options for a maximum of 7,000,000 shares may be granted under the plan. Outstanding options for a total of 4,990,3155,042,269 shares of our common stock are outstanding at the Record Date, of which 3,477,0494,150,845 may be exercised at this time. Outstanding options have exercise prices ranging from $5.00$1.09 to $13.00 per share.

Under the terms of our stock option plan, any options not vested will become immediately vested if the option holder dies, becomes permanently disabled or retires. If an option holder voluntarily resigns, any options not vested as of the date of resignation will terminate and all rights will cease, as determined by the compensation committeeCompensation Committee and documented in the option grant documents. In the event an option holder'sholder’s employment, board membership or status as an advisor is terminated for cause, the option holder'sholder’s right to exercise an option, whether or not vested, will immediately terminate and all rights will cease, unless the compensation committeeCompensation Committee determines otherwise.

Employee Savings Plan. We have established an employee savings plan that is intended to qualify as a tax-qualified plan under Section 401(k) of the Internal Revenue Code. This plan allows for voluntary contributions up to statutory maximums by eligible employees. We match a specific proportion of these contributions, subject

8

to limitations imposed by law. We may make additional contributions to the savings plan on behalf of our employees if our Board of Directors decides to do so. During theeach of three years ended December 31, 2000, 2001 and 2002,2004, we contributed $219,683, $252,597 and $337,252approximately $0.5 million to the savings plan on behalf of our employees.

Employee Stock Purchase Plan.Plan. Our Second Amended and Restated 2001 Employee Stock Purchase Plan (the "Stock“Stock Purchase Plan"Plan”) has been structured to qualify as an "employee“employee stock purchase plan"plan” under Section 423 of the Internal Revenue Code of 1986, as amended. Additionally, the Stock Purchase Plan authorizes the Compensation Committee of the Board of Directors to adopt sub-plans designed to achieve desired tax and other objectives in locations outside the United States. Up to 500,000 shares of our common stock may be issued during the term of the Stock Purchase Plan that is defined as December 1, 2001 through November 30, 2006. Employees will beare able to voluntarily participate in the Stock Purchase Plan through payroll deductions. Such deductions will accumulate during the participation periods, defined as three month periods. On the first business day of each participation period, each participant will beis deemed to have been granted an option to purchase common stock at 85% of its fair market value as measured by the closing price of the stock on either the first or last business day of the participation period, whichever is lower. The number of shares to be purchased is based upon the participant'sparticipant’s elected withholding amount. At the end of each participation period such option is automatically exercised.

Employment Agreements

We have entered into employment agreements with our Chief Executive Officer, Collin J. D'Silva,D’Silva, our Executive Vice President, John L. AllberyChief Financial Officer, Michael A. Summers and our Vice President and General Counsel, Keith A. Johnson. However, effective May 1, 2005, Mr. Johnson will no longer continue as an executive officer of the Company. The employment agreements with Messrs. D’Silva and Summers require these executives to devote their full time to our business activities, provided that they may serve as directors of or consultants to other companies that do not compete with us and for nonprofit corporations, civic organizations, professional groups and similar entities. These executives are not allowed to compete with us during the term of their employment and for aone year after they are no longer our employee. Each agreement contains provisions under which

10

these executive officers have agreed to maintain the confidentiality of information concerning us and which prohibits them from disclosing confidential information about our business to people outside of the Company, except for proper business purposes.

The employment agreement with Mr. D'SilvaD’Silva has an initiala term of four years22 months expiring February 29, 2004.December 2006. The employment agreement with Mr. Allbery has an initial term of four years expiring May 31, 2005. The employment agreement with Mr. JohnsonSummers has an initial term of three years expiring February 20, 2005.July 2007. Each of these agreements may be extended unless we or the employee, as the case may be, give notice of an intention not to renew. If one of these officers is terminated for reasons other than an act of serious misconduct, the officer will be entitled to severance pay in an amount equal to his then current base annual salary.

Report of the Compensation Committee Onon Executive Compensation

Executive Officer Compensation.Compensation The Compensation Committee consists only of directors who are not officers or employees of the Company.. The Compensation Committee endeavors to establish total compensation packages for the executive officers of the Company that fairly reflect the value of their services to the Company and that will permit the Company to attract and retain high quality individuals in its key executive positions, taking into consideration both the prevailing competitive job market and the current size and expected growth of the Company.

Executive officer compensation contains three principal components: (i) a base salary, (ii) a cash bonus and (iii) grants of options to purchase common stock under the Company'sCompany’s stock option plan. The base salaries for Collin D'Silva, John AllberyD’Silva and Keith JohnsonMike Summers are set forth in their employment agreements and are subject to annual increases as recommended by the Compensation Committee. The base salaries of other officers are determined as a function of their prior base salaries and the Compensation Committee'sCommittee’s view of base salary levels for executive officers with comparable positions and responsibilities in other companies and are not a function of any specific performance criteria. The Compensation Committee periodically compares base salaries paid to its executive

9

officers with those paid by other public companies engaged in similar industries and that generate revenues in the same range as the Company. These companies are not necessarily the same companies that are included in the peer group index used in the Performance Graph included in this Proxy Statement. In general, the Compensation Committee determined that the base salaries paid to the Company'sCompany’s executive officers fell within an appropriate range of base salaries paid by such comparable companies.

The bonus portion of executive officer compensation is based upon the performance goals established by the Compensation Committee and approved by the Board of Directors. In addition, the Compensation Committee may award additional bonus amounts on a discretionary basis if the Compensation Committee deems it to be appropriate based upon its assessment of an executive'sexecutive’s individual performance and the overall performance of the Company with respect to stockholder value, stock price, sales growth and net income. Based on these criteria, the Committee determined that no bonuses were to be awarded in 2004.

Because ownership of the Company'sCompany’s common stock serves to align the economic interests of its executive officers with those of its stockholders, executive officers who, in the opinion of the Compensation Committee, contribute to the growth, development and financial success of the Company may be awarded options to purchase common stock under the Company'sCompany’s stock option plan. Any grant of options to purchase common stock must be made with an exercise price no less than the closing sale price of the common stock on the date of grant. Therefore, the compensation value of these stock options is directly related to the long-term performance of the Company as measured by its future return to stockholders. The amount of stock option awards granted to executive officers are also determined on a discretionary basis by the Compensation Committee considering the same criteria used to establish base salary levels and award cash bonuses.

11

Compensation of Chief Executive Officer.Officer. Collin D'Silva'sD’Silva’s base salary is set by his employment agreement and is subject to annual increases as recommended by the Compensation Committee. It is the view of the Compensation Committee, based upon its periodic review of base salaries paid to chief executive officers of similarly situated companies, that Mr. D'Silva'sD’Silva’s base salary is reasonable and within an appropriate range paid by such other companies. Notwithstanding Mr. D'Silva'sD’Silva’s efforts during 2002,2004, Mr. D'SilvaD’Silva was not awarded a cash bonus and he was not awarded any stock options under the Company'sCompany’s stock option plan.

Compliance With Section 162(m) of the Internal Revenue Code. The current tax law imposes an annual, individual limit of $1 million on the deductibility of the Company'sCompany’s compensation payments to the Chief Executive Officer and to the four most highly compensated executive officers other than the Chief Executive Officer. Specified compensation is excluded for this purpose, including performance-based compensation, provided that certain conditions are satisfied. The Compensation Committee is determined to preserve, to the maximum extent practicable, the deductibility of all compensation payments to the Company'sCompany’s executive officers.

Jeffrey Sklar, M.D., Ph.D.

Roland Santoni

Parag Saxena

Compensation Committee Interlocks and Insider Participation

There are no compensation committeeCompensation Committee interlocks and no insider participation in compensation decisions that are required to be reported under the rules and regulations of the Securities Exchange Act of 1934.

Report of the Audit Committee

The Audit Committee is comprised of Roland Santoni, Jeffrey Sklar M.D., Ph.D.,Parag Saxena and Parag Saxena,Gregory Sloma, each of which is an independent director of the Company under the rules adopted by the Securities and Exchange Commission and the Nasdaq Stock Exchange. The Audit Committee operates under a written charter that is attached as an exhibit to this Proxy Statement.

10

The Company'sCompany’s management is responsible for the preparation of the Company'sCompany’s financial statements and for maintaining an adequate system of internal controls and processes for that purpose. Deloitte & Touche LLP ("Deloitte") acts as the Company'sCompany’s independent auditors and they are responsible for conducting an independent audit of the Company'sCompany’s annual financial statements in accordance with auditing standards generally accepted in the United States of America and issuing a report on the results of their audit. The Audit Committee is responsible for providing independent, objective oversight of both of these processes.

The Audit Committee has reviewed and discussed the audited financial statements for the year ended December 31, 20022004 with management of the Company and with representatives of Deloitte.Deloitte & Touche LLP. As a result of these discussions, the Audit Committee believes that the Company maintains an effective system of accounting controls that allow it to prepare financial statements that fairly present the Company'sCompany’s financial position, results of its operations and cash flows. Our discussions with Deloitte & Touche LLP also included the matters required by Statement on Auditing StandardsStandard No. 1,Communications61 (Communications with Audit CommitteesCommittees), as amended.

In addition, the Audit Committee reviewed the independence of Deloitte.Deloitte & Touche LLP. We received written disclosures and a letter from Deloitte & Touche LLP regarding its independence as required by IndependenceIndependent Standards Board Standard No. 1Independence Discussions with Audit Committees, and this information was discussed with Deloitte.Deloitte & Touche LLP.

12

Based on the foregoing, the Audit Committee has recommended that the audited financial statements of the Company for the year ended December 31, 20022004, be included in the Company'sCompany’s Annual Report on Form 10-K10-K/A-2 to be filed with the Securities and Exchange Commission.

Roland J. Santoni

Parag Saxena

Gregory T. Sloma

Company Performance

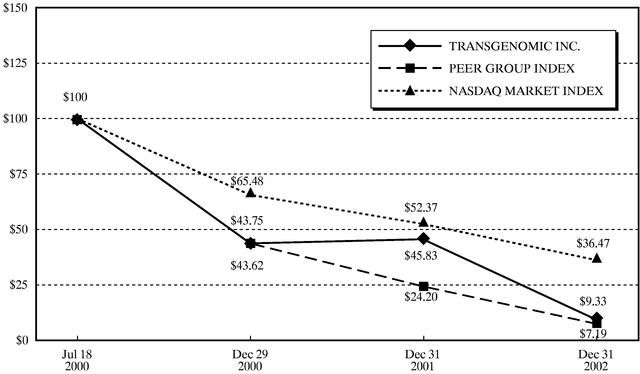

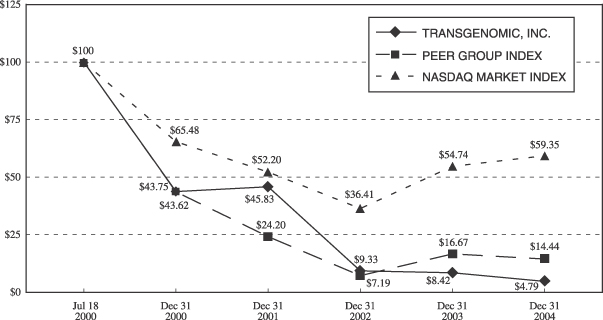

In accordance with SEC rules, the following table shows a line-graph presentation comparing cumulative, total stockholder returns with a broad equity market index and an index of peer companies selected by us for the period commencing July 18, 2000, the date on which our stock began public trading, and ending December 31, 2002.2004. We have selected the Nasdaq Market Index for the broad equity market index and the Peer Group Index consisting of the following companies:

Aclara Biosciences, Inc. Argonaut Technologies, Caliper Cepheid Ciphergen Biosystems, Inc. Harvard Bioscience, Inc. | Illumina, Inc. Luminex Corporation Nuvelo, Inc. Orchid BioSciences, Inc. Sequenom, Inc. |

11

The stock price information shown on the following graph below is not necessarily indicative of future price performance.

| | July 18, 2000 | December 29, 2000 | December 31, 2001 | December 31, 2002 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Transgenomic, Inc. | $ | 100.00 | $ | 43.75 | $ | 45.83 | $ | 9.33 | ||||

| Nasdaq Market Index | $ | 100.00 | $ | 65.48 | $ | 52.37 | $ | 36.47 | ||||

| Peer Group Index | $ | 100.00 | $ | 43.62 | $ | 24.20 | $ | 7.19 | ||||

13

| December 31, | ||||||||||||||||||

| July 18, 2000 | 2000 | 2001 | 2002 | 2003 | 2004 | |||||||||||||

Transgenomic, Inc. | $ | 100.00 | $ | 43.75 | $ | 45.83 | $ | 9.33 | $ | 8.42 | $ | 4.79 | ||||||

Nasdaq Market Index | $ | 100.00 | $ | 65.48 | $ | 52.20 | $ | 36.41 | $ | 54.74 | $ | 59.35 | ||||||

Peer Group Index | $ | 100.00 | $ | 43.62 | $ | 24.20 | $ | 7.19 | $ | 16.67 | $ | 14.44 | ||||||

Assumes $100 invested on July 18, 2000 in Transgenomic'sTransgenomic’s common stock, the Nasdaq Market Index and the Peer Group Index, with reinvestment of dividends.

RATIFICATION OFPROPOSAL TO RATIFY APPOINTMENT OF INDEPENDENT AUDITOR

The Audit Committee of the Board of Directors has appointed Deloitte & Touche LLP ("Deloitte") to be our independent auditors for 2003.2004. We are asking our stockholders to ratify the appointment of Deloitte. In recommending the appointment of Deloitte to be our independent auditors, the Audit Committee considered whether the provision of the services by Deloitte described below under the headings "Financial Information Systems Design and Implementation Fees" and "All Other Fees" is compatible with maintaining Deloitte's independence from the Company and our management.

Audit Fees

The aggregate fees billed by Deloitte or its affiliates for professional services rendered for the audit of the Company's annual financial statements for the fiscal year ended December 31, 2002, and for the reviews of the financial statements included in the Company's Quarterly Reports on Form 10-Q for that fiscal year were approximately $146,000.

Financial Information Systems Design and Implementation Fees

There were no fees billed by Deloitte or its affiliates for professional services rendered for information technology services relating to financial information systems design and implementation for the fiscal year ended December 31, 2002.

All Other Fees

The aggregate fees billed by Deloitte or its affiliates for services rendered to the Company, other than the services described above under "Audit Fees" and "Financial Information Systems Design and Implementation Fees", for the fiscal year ended December 31, 2002, were approximately $47,000. These fees were primarily associated with attestation services related to the audit of our employee benefit plan and consultation related to tax planning and compliance rendered by Deloitte during the year.

& Touche LLP. The ratification of the appointment of our auditor requires the affirmative vote of the holders of a majority of the shares present in person or represented by proxy at the meeting and entitled to vote. Abstentions will have the same effect as a vote against ratification. Broker nonvotes will not be considered shares entitled to vote with respect to ratification of the appointment and will not be counted as votes for or against the ratification.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" THE RATIFICATION OF THE APPOINTMENT OF DELOITTE

The Board of Directors recommends that stockholders vote “FOR” the ratification of the appointment of Deloitte & TOUCHETouche LLP AS THE COMPANY'S AUDITORS FOR FISCAL 2003.as the Company’s independent auditors for 2005.

Representatives of Deloitte & Touche LLP are expected to be present in person or by telephonic conference at the Annual Meeting and will be provided an opportunity to make a statement and to respond to appropriate inquiries from stockholders.

12

The following fees were billed by Deloitte & Touche LLP to us for professional services provided during 2004 and 2003:

Audit Fees. Deloitte & Touche LLP billed us a total of $250,000 and $227,000 in 2004 and 2003, respectively, for professional services rendered for the audit of our annual financial statements for those fiscal years and to review our interim financial statements included in Quarterly Reports on Form 10-Q filed by us with the SEC during those years.

Audit-Related Fees. Deloitte & Touche LLP billed us a total of $42,000 and $46,000 in 2004 and 2003, respectively, for audit-related services. Audit-related services generally include fees for the audits of our employee benefit plans and fees incurred in connection with services associated with SEC registration statements, periodic reports and other documents filed with the SEC or other documents issued in connection with securities offerings and research consultation on proposed transactions.

Tax Fees. Deloitte & Touche LLP billed us a total of $44,000 and $33,000 in 2004 and 2003, respectively, for tax services. Tax services consisted primarily of planning, advice and compliance, or return preparation, for U.S. federal, state and local, as well as international jurisdictions.

All Other Fees. Deloitte & Touche LLP did not render any services other than the services described under the above captions in 2004 and 2003.

The Audit Committee approved all services provided by Deloitte during fiscal year 2004 and has determined that the provision of these services did not adversely affect Deloitte’s independence. It is currently the policy of the Audit Committee to review and pre-approve all services provided by the independent auditor to the Company in order to assure that the provision of such services does not impair the auditor’s independence. Unless a type of service to be provided by the independent auditor has received general preapproval, it will require specific preapproval by the Audit Committee. Any proposed services exceeding preapproved cost levels will require specific preapproval by the Audit Committee. The term of any preapproval is 12 months from the date of preapproval, unless the Audit Committee specifically provides for a different period.

PROPOSAL TO AUTHORIZE THE COMPANY TO ISSUE AN UNLIMITED NUMBER OF SHARES UNDER ITS $7.5 MILLION CONVERTIBLE REVOLVING CREDIT LINE WITH LAURUS MASTER FUND, LTD. AND ASSOCIATED WARRANTS, WHICH MAY EXCEED 20% OF THE SHARES OUTSTANDING ON THE DATE THE COMPANY ENTERED INTO THE CREDIT LINE.

General

We are asking stockholders to approve a proposal that will increase our ability to convert amounts borrowed by us under our $7.5 million convertible revolving credit line (the ”Credit Line”) with Laurus Master Fund, Ltd. (“Laurus”) into shares of our common stock. In particular, we are asking stockholders to authorize the Company to issue shares of our common stock in excess of 20% of the number of shares that were outstanding on December 3, 2003 (the date we entered into the Credit Line) if needed to allow Laurus to convert borrowings under the Credit Line into shares of common stock or to exercise the warrants we issued to Laurus in connection with the Credit Line. Due to the revolving nature of the Credit Line, with the approval of our stockholders, the number of shares that may be issued to Laurus upon conversion of this facility will be unlimited. By converting borrowings under the Credit Line into common stock, we are able to borrow additional funds under the Credit Line which may be necessary from time to time to meet our liquidity needs or make capital expenditures. Without the ability to continue to convert these borrowings into common stock, we may not have access to sufficient debt financing to meet our liquidity needs in the future or to fund necessary capital expenditures. Converting our borrowings under the Credit Line into common stock will also allow us to reduce our interest expense and the cash needed to make interest payments.

13

The proposal to authorize the Company to issue and unlimited number of shares under the Credit Line and associated warrants, which may exceed 20% of the shares outstanding on the date the Company entered into the Credit Line requires the affirmative vote of the holders of a majority of the issued and outstanding shares of our common stock. Accordingly, abstentions and broker nonvotes will have the same effect as a vote against this proposal.

The Board of Directors recommends that stockholders vote “FOR” the proposal to authorize the Company to issue an unlimited number of shares under the Credit Line and associated warrants, which may exceed 20% of the shares outstanding on the date the Company entered into the Credit line.

Reasons for the Proposal

Because shares that we will issue in future conversions of borrowings under the Credit Line will be issued at effective conversion prices below the closing sale price of our shares as of December 3, 2003 ($1.80 per share), the listing requirements of the Nasdaq Stock Market limit the total number of shares we can issue under the Credit Line and associated warrants to 20% of the total shares of our common stock outstanding as of that date unless our stockholders grant their approval to the issuance of shares in excess of this amount. Accordingly, a maximum of 5,595,705 shares of common stock may be issued by us to Laurus pursuant to the Credit Line and associated warrants without approval from our stockholders. Since entering into the Credit Line, Laurus has converted principal of $3.86 million into 4,509,091 shares of our common stock. Laurus also holds warrants to purchase 940,000 shares of our common stock at a weighted average exercise price per share of $1.88 that were issued in connection with the Credit Line. While Laurus has not exercised any of these warrants, we are required to keep this number of shares available for issuance upon exercise of these warrants. Accordingly, we can issue only 146,614 additional shares of our common stock to Laurus in conjunction with debt conversions under the Credit Line without additional authority from our stockholders.

We are proposing that stockholders authorize the Company to issue an unlimited number of shares of common stock in connection with the Credit Line and associated warrants. The conversion price set forth in the Credit Line is currently $1.00 per share. However, on one occasion we waived the stated conversion price and authorized conversion of debt to equity at prices as low as 90% of the current market price of our common stock in order to facilitate conversions of debt. We have also twice agreed with Laurus to lower the stated conversion price under the Credit Line in order to obtain a waiver of our borrowing limit under the Credit Line and other concessions. We currently expect that future conversions of borrowings under the Credit Line will be made at $1.00 per share. However, we may decide to convert these borrowings into common stock at lower prices if we determine that it is necessary to ensure that the Company has adequate borrowing capacity under the Credit Line. However, we will not convert debt under the Credit Line into common stock at a conversion price that is less than 90% of the then current market value of our common stock.

We entered into the Credit Line on December 3, 2003. The term of the Credit Line is three years carrying an interest rate of 2.0% over the prime rate or a minimum of 6.0%. Funds available under the Credit Line are determined by a borrowing base equal to 90% of eligible accounts receivable balances plus up to $1.0 million related to inventory balances. The Credit Line is secured by most of our assets. Originally, the Credit Line provided that payment of interest and principal could, under certain circumstances, be made with shares of our common stock at a fixed conversion price of $2.20 per share. Conversion of this debt to common stock may be made at the election of Laurus or the Company. We may also elect to convert debt but only if our shares trade at a price exceeding $2.42 per share for ten consecutive trading days, and such conversion is further subject to trading volume limitations and a limitation on the total beneficial ownership by Laurus of our common stock. Upon entering into the Credit Line, we issued warrants to Laurus to acquire 550,000 shares of the our common stock at an exercise price exceeding the average trading price of our common stock over the ten trading days prior to the date of the warrant.

In February 2004, Laurus waived the borrowing base limitation on the Credit Line, thereby making the full $7.5 million facility available to us regardless of the available collateral. On August 31, 2004, Laurus agreed to

14

extend the borrowing base waiver on the Credit Line through March 19, 2005. In addition, Laurus reduced the interest rate on the Credit Line to 0% for any day the closing sale price of our common stock is at or above $1.75 per share. In return, we agreed to lower the conversion price to $1.00 per share and issued a warrant to Laurus covering an additional 400,000 common shares at an exercise price of $1.25 per share. The closing price of our common stock on August 31, 2004 was $1.20 per share. On March 18, 2005, Laurus agreed to further extend the borrowing base waiver on the Credit Line until March 31, 2006. In connection with this waiver, we agreed to allow Laurus to convert $1.87 million of the outstanding principal balance under the Credit Line into 3,600,000 shares of common stock. As a result of the extension of the borrowing base waiver and the conversion of this $1.87 million of outstanding debt into equity, we had available borrowing capacity under the Credit Line of $2.60 million at March 31, 2005. While we believe the available capacity under the Credit Line is sufficient to meet our liquidity requirements for 2005, management believes that it would be in the best interests of the Company to take steps to expand its access to additional capital under the Credit Line by authorizing additional shares to be available to issue upon conversion of borrowings under the Credit Line into common stock.

Certain Risks Associated with the Proposal to Increase the Number of Shares Issuable under the Credit Line.

The issuance of additional shares will reduce the ownership of existing stockholders and may be dilutive. By authorizing the Company to issue additional shares of common stock in order to convert borrowings under the Credit Line into common stock, an unlimited number of additional shares may be issued for such purposes. We also have obligations to issue approximately 6.2 million shares of common stock under outstanding stock options and warrants. Additionally, we may issue shares of common stock upon conversion of all or part of our borrowings under a separate $2.75 million Term Note with Laurus. The issuance of such additional shares of common stock will reduce the proportionate ownership of existing stockholders. In addition, the issuance of these additional shares may be dilutive to our current stockholders and could negatively impact the market price of our common stock.

The sale by Laurus of shares issued to it upon conversion of borrowings may reduce the market price of our stock. Under the terms of the Credit Line, Laurus may not own more than 4.99% of our outstanding common stock at any time. We have agreed to register the shares issued to Laurus for resale under federal securities laws. Accordingly, upon conversion of borrowings under the Credit Line into common stock, Laurus will generally be required to sell most or all these shares in the market. Because the average trading volume for shares of our common stock is relatively modest, the sale by Laurus of a substantial number of shares from time to time could cause the trading price for our common stock to decline in order for the market to clear these sales.

SUBMISSION OF STOCKHOLDER PROPOSALS

Pursuant to our Bylaws, stockholder proposals submitted for presentation at the Annual Meeting, including nominations for directors, must be received by our corporate secretarySecretary at the address of our home office no later than 35 days prior to the date of the Annual Meeting. If less than 35 days'days’ notice of the Annual Meeting is given, then stockholder proposals must be received by our corporate secretarySecretary no later than seven days after the mailing date of the notice of the Annual Meeting to stockholders.

14

Any stockholder nomination for director must set forth the name, age, address and principal occupation of the person nominated, the number of shares of our common stock owned by the nominee and the nominating stockholder and other information required to be disclosed about the nominee under federal proxy solicitation rules.

In order to be included in our proxy statementProxy Statement relating to next year'syear’s annual meeting, stockholder proposals must be submitted in writing by December 19, 2003February 22, 2006 to our corporate secretarySecretary at the address of our home office. The inclusion of any such proposal in our proxy materials will be subject to the requirements of the proxy rules adopted under the Securities Exchange Act of 1934, as amended.

15

Management does not currently intend to bring any matter before the Annual Meeting other than those disclosed in the Notice of Annual Meeting of Stockholders, and it does not know of any business which persons, other than the management, intend to present at the meeting. The enclosed proxy for the Annual Meeting confers discretionary authority on the Board of Directors to vote on any matter proposed by stockholders for consideration at the Annual Meeting if the Company did not receive written notice of the matter on or before March 5, 2003.Meeting.

We will bear the cost of soliciting proxies for the Annual Meeting. To the extent necessary, proxies may be solicited by our directors, officers and employees, but these persons will not receive any additional compensation for such solicitation. We will reimburse brokerage firms, banks and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy materials to the beneficial owners of our common stock. In addition to solicitation by mail, we will supply banks, brokers, dealers and other custodian nominees and fiduciaries with proxy materials to enable them to send a copy of such materials by mail to each beneficial owner of our common stock that they hold of record and will, upon request, reimburse them for their reasonable expenses in so doing.

Stockholders may communicate with any director, including the Chairman of the Board and the chairman of any committee of the Board, by sending a letter to the attention of the appropriate person (which may be marked as confidential) addressed to our corporate Secretary at our home office. All communications received by the corporate Secretary will be forwarded to the appropriate directors. In addition, it is the policy of our Board of Directors that whenever possible directors attend, and be available to discuss stockholder concerns at, the Annual Meeting. Collin J. D’Silva attended last year’s Annual Meeting.

Our Form 10-K,10-K/A, as filed by the Company with the Securities and Exchange Commission, is included in our Annual Report that is being delivered to our stockholders together with this Proxy Statement. The Form 10-K10-K/A is not, however, to be considered part of this proxy solicitation material.

None of the information set forth in this Proxy Statement under the headings "Report“Report of the Compensation Committee on Executive Compensation," "Report” “Report of the Audit Committee"Committee” or "Company Performance"“Company Performance” is deemed to be "soliciting material"“soliciting material” or to be "filed"“filed” with the SEC or subject to the SEC'sSEC’s proxy rules or to the liabilities of Section 18 of the Securities Exchange Act of 1934 (the "1934 Act"“1934 Act”), and this information will not be deemed to be incorporated by reference into any prior or subsequent filing by the Company under the Securities Act of 1933 or the 1934 Act.

By Order of | ||

Omaha, NebraskaApril 18, 2003

15

EXHIBIT

AMENDED CHARTEROF THE AUDIT COMMITTEEOF THE BOARD OF DIRECTORSOF TRANSGENOMIC, INC.

I. Audit Committee Purpose.

The Audit Committee is appointed by the Board of Directors to assist the Board in fulfilling its oversight responsibilities. The Audit Committee' s primary duties and responsibilities are to:

The Audit Committee has the authority to conduct any investigation appropriate to fulfill its responsibilities, and has direct access to the independent auditors as well as anyone in the organization. The Audit Committee has the ability to retain, at the Company's expense, independent special legal, accounting, or other consultants or experts it deems necessary in the performance of its duties.

II. Audit Committee Composition and Meetings.Mitchell L. Murphy,Secretary

Audit Committee members shall meet the requirements of the National Association of Securities Dealers, Inc. ("NASD"). The Audit Committee shall be comprised of three or more directors as determined by the Board, each of whom shall be independent (as defined in Rule 4200(a)(14) of the NASD's listing standards) directors who are not officers of the Company and are, in the view of the Board, free from any relationship that would interfere with the exercise of his or her independent judgment. All members of the Committee shall have a basic understanding of finance and accounting and be able to read and understand fundamental financial statements, and at least one member of the Committee shall be a "financial expert" as defined by the rules of the Securities and Exchange Commission ("SEC"). Members of the Audit Committee shall comply with any continuing education requirements adopted from time to time by the Nasdaq Stock Market, Inc.

Audit Committee members shall be appointed by the Board of Directors in accordance with the Bylaws of the Company, as they may be amended from time to time. If an Audit Committee Chair is not designated or present, the members of the Committee may designate a Chair by majority vote of the Committee membership.Omaha, Nebraska

The Committee shall meet at least four times annually, or more frequently as circumstances dictate, which meetings shall be governed by the applicable provisions of the Bylaws of the Company. The Audit Committee Chair shall prepare and/or approve an agenda in advance of each meeting. The Committee should meet privately in executive sessions at least quarterly with management, the independent auditors, and as a committee to discuss any matters that the Audit Committee or each of these groups believe should be discussed. A written record of all meetings of the Audit Committee shall be maintained. The results of each Audit Committee meeting will be reported to the full Board of Directors.June 22, 2005

A-1

III. Audit Committee Responsibilities and Duties.

Review Procedures.16

A-2

Independent Auditors.

A-3

Internal Audit Department and Legal Compliance.

A-4

A-5

TRANSGENOMIC, INC.

ANNUAL MEETING OF STOCKHOLDERS

Wednesday, May 21, 2003

July 13, 2005 10:30 A.M., Eastern Daylight Time

INVESCO PRIVATE CAPITAL

1166 Avenue of the Americas

New York, New York

| ||

TRANSGENOMIC, INC. revocable proxy

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF TRANSGENOMIC, INC. FOR USE ONLY AT THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON WEDNESDAY, MAY 21, 2003JULY 13, 2005 AND AT ANY ADJOURNMENT THEREOF.

The undersigned hereby authorizes the Board of Directors of Transgenomic, Inc. (the "Company"“Company”), or any successors in their respective positions, as proxy, with full powers of substitution, to represent the undersigned at the Annual Meeting of Stockholders of the Company to be held at the offices of INVESCO Private Capital, 1166 Avenue of the Americas, New York, New York, on Wednesday, May 21, 2003,July 13, 2005, at 10:30 a.m., Eastern Daylight Time, and at any adjournment of said meeting, and thereat to act with respect to all votes that the undersigned would be entitled to cast, if then personally present, in accordance with the instructions below and on the reverse hereof.

THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED STOCKHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR THE ELECTION OF THE BOARD OF DIRECTORS' NOMINEEDIRECTORS’ NOMINEES FOR DIRECTOR, AND FOR THE RATIFICATION OF THE APPOINTMENT OF AUDITORS.AUDITORS AND TO AUTHORIZE THE COMPANY TO ISSUE AN UNLIMITED NUMBER OF SHARES TO LAURUS MASTER FUND, LTD.

This proxy is revocable and the undersigned may revoke it at any time prior to the Annual Meeting by giving written notice of such revocation to the Secretary of the Company. Should the undersigned be present and want to vote in person at the Annual Meeting, or at any adjournment thereof, the undersigned may revoke this proxy by giving written notice of such revocation to the Secretary of the Company on a form provided at the meeting. The undersigned hereby acknowledges receipt of a Notice of Annual Meeting of Stockholders of the Company called for May 21, 2003July 13, 2005, the Proxy Statement for the Annual Meeting and the Company's 2002Company’s 2004 Annual Report to Stockholders prior to the signing of this proxy.

(continuedContinued and to be signed on the reverse hereof).hereof.)

\*/

Please detach here \*/

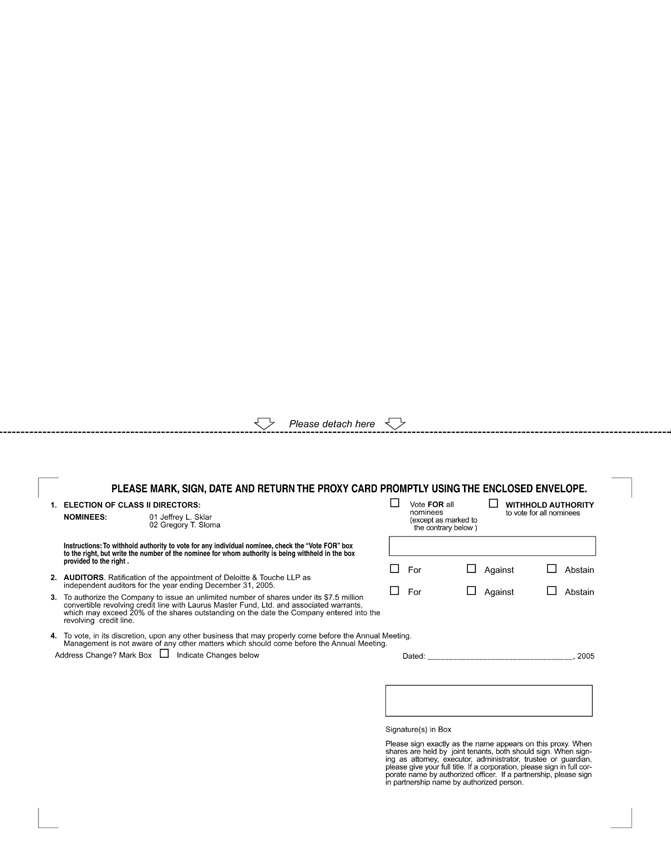

PLEASE MARK, SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE.

Instructions: To withhold authority to vote for any individual nominee, check the “Vote FOR” box to the right, but write the number of the nominee for whom authority is being withheld in the box provided to the right .

2. AUDITORS. Ratification of the appointment of Deloitte & Touche LLP as independent auditors for the year ending December 31, 2005.

3. To authorize the Company to issue an unlimited number of shares under its $7.5 million convertible revolving credit line with Laurus Master Fund, Ltd. and associated warrants, which may exceed 20% of the shares outstanding on the date the Company entered into the revolving credit line.

4. To vote, in its discretion, upon any other business that may properly come before the Annual Meeting. Management is not aware of any other matters which should come before the Annual Meeting.

Address Change? Mark Box Indicate Changes below

Vote FOR all nominees (except as marked to the contrary below )

WITHHOLD AUTHORITY to vote for all nominees

For Against Abstain

For Against Abstain

Dated: , 2005

Signature(s) in Box

Please sign exactly as the name appears on this proxy. When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give your full title. If a corporation, please sign in full corporate name by authorized officer. If a partnership, please sign in partnership name by authorized person.